New brief explores unlocking finance for the private health sector

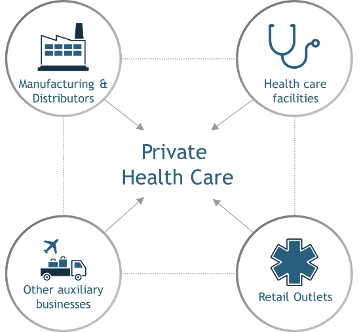

Private sector engagement is an important strategy in achieving sustainable family planning, maternal and child health, and other health outcomes. Despite its important role, the private health sector in many countries faces challenges, chief among them access to finance. Financing in the form of equity loans and support for investment funds and other financial products is critical for the private sector to flourish. This brief provides USAID missions and implementing partners with an overview of the challenges around a range of private health sector actors accessing finance, definitions of blended and innovative financing, information on the US International Development Finance Corporation, illustrative examples of innovative financing, and case studies on health from multiple regions.

Private sector engagement is an important strategy in achieving sustainable family planning, maternal and child health, and other health outcomes. Despite its important role, the private health sector in many countries faces challenges, chief among them access to finance. Financing in the form of equity loans and support for investment funds and other financial products is critical for the private sector to flourish. This brief provides USAID missions and implementing partners with an overview of the challenges around a range of private health sector actors accessing finance, definitions of blended and innovative financing, information on the US International Development Finance Corporation, illustrative examples of innovative financing, and case studies on health from multiple regions.

USAID has been a leader in recognizing the role that access to finance plays in addressing shortages and expanding quality family planning and maternal and child health products and services, among other essential health services in low- and middle-income countries. USAID has pioneered a number of innovative strategies to address the financing constraint, including the structuring of Development Credit Authority loan guarantees, a risk-sharing mechanism that encourages financial institutions to finance underserved markets. In 2019, the US International Development Finance Corporation (DFC) was established, bringing together the capabilities of the Overseas Private Investment Corporation and USAID’s Development Credit Authority. DFC introduced new financial products to bring private capital to low- and middle-income countries. This has resulted in more flexibility to support investments in the private health sector, among other benefits.

USAID has been a leader in recognizing the role that access to finance plays in addressing shortages and expanding quality family planning and maternal and child health products and services, among other essential health services in low- and middle-income countries. USAID has pioneered a number of innovative strategies to address the financing constraint, including the structuring of Development Credit Authority loan guarantees, a risk-sharing mechanism that encourages financial institutions to finance underserved markets. In 2019, the US International Development Finance Corporation (DFC) was established, bringing together the capabilities of the Overseas Private Investment Corporation and USAID’s Development Credit Authority. DFC introduced new financial products to bring private capital to low- and middle-income countries. This has resulted in more flexibility to support investments in the private health sector, among other benefits.

In addition to DFC, other financial and development institutions throughout the world are venturing into the global health sector with financing solutions that address the financing gap. Increasingly, there is an interest in partnerships between government, donors, philanthropists, impact investors, and the private sector to develop new and blended finance strategies. Using private resources, these strategies are backed by public funds to (1) support innovation and (2) scale-up and encourage the private sector to enter new markets, while reducing risk. USAID missions and implementing partners can leverage these solutions to address financing gaps that negatively affect the private health sector’s ability to contribute to positive public health outcomes.

Read the brief here.