Innovative financing for drug retailers to secure family planning inventory

Pharmacies and drug shops fill a vital role providing family planning methods, particularly for those living in hard-to-reach areas. Yet many outlets struggle with financing to maintain stocks. A new SHOPS Plus brief examines innovative opportunities to expand access to finance for pharmacies and drug shops throughout the supply chain, including a promising case study from Nigeria, which leveraged USAID resources to spur continued bank lending.

According to a SHOPS Plus analysis of Demographic and Health Surveys data from 36 low- and middle-income countries, 41 percent of women bought their contraceptives at pharmacies or drug shops. To purchase stock, the outlets often rely on their working capital, which is frequently insufficient to maintain adequate levels of inventory. They also depend on supplier credit, which are often small amounts with short repayment periods; loans from microfinance institutions, which carry high interest rates; or loans from commercial banks, which have stringent requirements and are difficult to access.

The SHOPS Plus team found that tailored loan products through interested financial institutions widened access to finance for pharmacies and drug shops. In the Nigeria case, implementers also used a partnership with the Association of Community Pharmacists of Nigeria and support from USAID to build confidence in the commercial viability of drug shops and pharmacies. This resulted in continued lending to these crucial outlets after the project ended—with the partner financial institution using the project’s tools to assess creditworthiness and training materials for loan officers.

Replicating and expanding these efforts means understanding the ecosystem of all potential partners—including associations, financial institutions, and suppliers—as well as their roles and the benefits they bring. For example, in Tanzania, SHOPS Plus structured a partnership with a microfinance institution and a regional drug shop association and added a pharmaceutical supplier. Loan funds are disbursed directly to the supplier against an invoice, and the drug shop then repays the loan directly to the microfinance institution. This arrangement reduces credit risk, ensures quality of commodities, and lowers the cost to drug shops by bypassing the distributor markup.

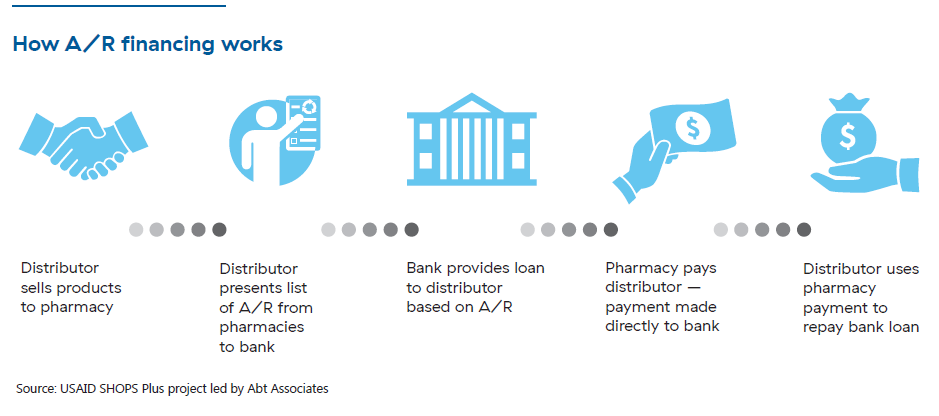

Two additional models offer ways to inject more liquidity into the supply chain through pharmaceutical distributors. A/R (accounts receivable) financing enables a financial institution to use the money owed to a distributor through supplier credit as a repayment source or collateral—so the distributor can extend credit to the pharmacy.

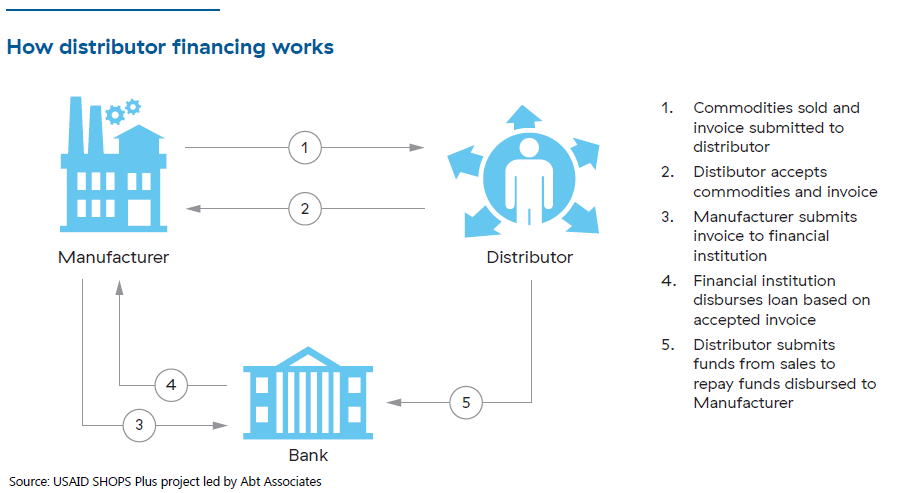

Distributor financing linked to a specific manufacturer of pharmaceuticals can enable the distributor to purchase more stock and extend more credit to drug shops and pharmacies.

Looking along the supply chain reveals opportunities to use different financing models, which would enable small, private providers of family planning to more reliably serve their customers.

Download the brief.

Learn more about our work in provider access to finance.