Digital financial services for health in the MENA region

What have digital financial services got to do with health? A lot, as it turns out.

Digital financial services (DFS), the provision of financial services through digital channels, lend broad support to development goals and private sector engagement. They are part of the larger phenomenon of digitization and the movement for financial inclusion taking root around the world. SHOPS Plus looks to catalyze the use of DFS in the MENA region to help improve health outcomes.

Digital financial services, such as mobile money, enable people to use financial services to improve livelihoods. Private providers of DFS can partner with public sponsors of programs that support jobs, gender equality, food security – and health.

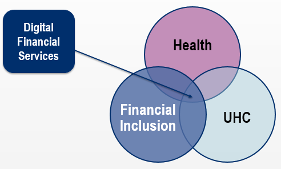

Within the health sector, greater financial inclusion can help people pay for health care when they need it. DFS can support progress toward universal health coverage (UHC) by expanding affordable and equitable access to health products and services and extending the reach of health financing schemes. DFS can improve the resilience of health systems, too, by enhancing their responsiveness, streamlining their financial processes, and complementing broader digital solutions to collect and use health data and deliver care.

Digital financial services enable UHC, health and financial inclusion

The epicenter for DFS is sub-Saharan Africa, home to more than half of the 700 million DFS account holders worldwide. They use DFS such as M-Pesa (mobile money) and more recently, a digital health wallet called M-Tiba in Kenya.

In contrast, an assessment by SHOPS Plus notes that 11 focus countries in the Middle East and North Africa (MENA) region have the lowest financial account ownership in the world. There, DFS are nascent – cash remains king. Four main barriers behind this: conflict and humanitarian and economic crises; a risk adverse banking culture; low trust in financial institutions, and a substantial gender gap.

Despite these barriers, the time is ripe for DFS to expand in the MENA region. The region boasts widespread mobile phone and internet access. Mobile internet use grew by 30% in the last 4 years; today, 90% of the population in the MENA region lives within range of a mobile signal. Policy and regulatory environments are improving. For example, reforms in a number of MENA countries aim to allow non-banks to provide financial services, which invite new players to enter the market. More flexible “know your customer” regulations can permit people to open accounts remotely while not compromising data security. Innovation hubs, venture capital and regulatory waivers for financial technology providers can foster innovation and collaboration among regulators and innovators. And investors and donors want to participate. Organizations like the Alliance for Financial Inclusion are investing in financial inclusion, especially for refugees and women.

DFS are making inroads in the health sector in the MENA region, too. For example, Egypt is undertaking reforms to digitize the insurance sector. Demand for telemedicine and other digital solutions has spiked in the wake of the COVID-19 pandemic. There are more opportunities for DFS to make it easier for people in the MENA region to access the health care they need.

To accelerate DFS for health, stakeholders should:

- increase awareness within the health sector of these services

- facilitate exchanges for health insurance stakeholders to learn from international best practices

- invest in additional research

To learn more, watch an e-conference on DFS in the MENA region, or read a report on the e-conference.

Defining DFS and financial inclusion

DFS:

- Refer to financial services delivered through digital channels used to store, transfer, and track funds.

- Include debit cards, mobile phone accounts, internet, and point-of-sale terminals.

- Can be implemented by banks, mobile network operators, microfinance institutions, insurance providers, financial technology companies, and others.

- Encompass terms that describe transactions such as mobile money, mobile banking, m-wallets, e-wallets, e-payment, and e-banking.

Financial inclusion:

- Refers to making financial products and services, “financial accounts,” accessible and affordable to all.